Types of Planned Gifts

WHAT IS PLANNED GIVING?

Planned giving encompasses a variety of ways that gifts can be made to the church from accumulated resources. It usually involves financial or estate planning; however, it is not reserved for the wealthy.

Planned giving is a means by which anyone concerned with the wise use of his or her personal resources makes a considered choice about their ultimate disposition.

In general planned gifts are made through:

Pooled Income Fund

Charitable Gift Annuity

Charitable Remainder Trust

Real estate

Closely held stock

Life insurance

Retirement accounts

Planned giving establishes a way for a donor to provide for family members while remembering the church as well. It often enables the donor to provide more for his or her heirs and to make a larger gift than thought possible. It often reduces taxes as well.

Planned gifts can be designated for an organization’s general funds or its endowment. Planned gifts are either outright gifts (i.e., gifts of appreciated securities, real property, personal property, etc.) or deferred gifts (i.e. bequests, charitable gift annuities, charitable trusts).

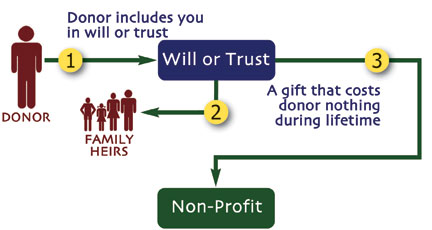

a bequest in a will

Perhaps the easiest and most common way of making a planned gift is through your will. Yet over 50% of Americans do not have one. If you die without a will, the state will divide your assets among your spouse and children (regardless of their age); appoint an administrator that may cost the estate large fees; and appoint guardians, who may or may not have been your choice, for your dependents. The state makes no charitable contributions, and it will ensure that your estate pays as much tax as possible.

By making a will, you appoint your own administrator; you name the guardian of your dependents; you control applicable taxes; you can create a family or charitable trust; and you can share your resources with your family, church, or other institutions as you choose.

A bequest in a will can take the form of a set amount of money, a percentage of an estate, a specific asset, a trust, or the naming of a church-related organization as a contingent beneficiary. Sample language for including the church in your will might be: “I give, devise, and bequeath (state amount, asset, or percentage of the estate) to (name and address of your church) to be used (describe use) or as the church’s governing board or vestry deems appropriate.”

LIFE INCOME GIFTS

Life income gifts provide you or your designated beneficiary income for life in exchange for your gift. The three most common types of life income gifts are a pooled income fund, a charitable gift annuity, and a charitable remainder trust.

In the Pooled Income Fund, gifts ($2,500 gift minimum) are “pooled” with other gifts and invested in a professionally managed investment portfolio. The donor receives the following benefits:

A guaranteed income for life. The amount of the income depends on the rate of return on the fund ’s investments. The income can also flow to another designated beneficiary

An immediate federal income tax deduction. The amount of the deduction is usually based on the age of the donor and/or beneficiaries

The elimination of capital gains taxes, if funded through appreciated securities such as stocks, bonds, or mutual funds

A possible reduction in estate taxes

At the death of the final beneficiary, the property goes to the church or church-related beneficiary that you named.

The benefits of establishing a Charitable Gift Annuity are similar to that of the pooled income fund with the following differences:

The minimum gift is $5,000

The income for life is guaranteed at a fixed amount

A portion of the gift is deductible

A portion of the income received is tax exempt

A Charitable Remainder Trust is available to donors using assets of $100,000 or more. They can be funded with various types of assets, including real estate. Like the pooled income fund and the charitable gift annuity, the charitable remainder trust provides income for life, an income tax deduction, relief from capital gains taxes (if funded through appreciated property), and a possible reduction in estate taxes. The income fluctuates based on the performance of the portfolio. If you are seeking fixed income annually, a charitable remainder annuity trust is an option to consider.

The Charitable Lead Trust, another estate planning tool, enables you to transfer assets to a trust that pays its income to the church or church-related organization for a set period of time. At the end of the term, the principal and all capital appreciation returns to you or others that you name.

GIFTS OF REAL ESTATE, APPRECIATED PROPERTY, AND TANGIBLE PERSONAL PROPERTY

Real estate or securities can be the source of your gift to the church. Using a Charitable Life Estate Contract, for example, you can deed your home, vacation home, farm, ranch, or condominium to the church and retain the right to live on the property and/or receive income from the property for as long as you live. You receive an income tax deduction when the property is deeded to the church and normally avoid any capital gains taxes when making the transfer. Your inheritance and estate taxes may be reduced at the time of your death.

Gifts of appreciated real estate or securities allow you to avoid capital gains taxes. It is important to transfer the stock or real estate to the church prior to selling it. However, if the securities or real estate have decreased in value, you should sell the assets before making the gift, thus establishing a capital loss and a potential tax deduction.

Gifts of tangible personal property, such as jewelry, coins, works of art, automobiles, etc. may also be given to the church. You are responsible for setting an appraised value on the gift. Any gift over $5,000 must be independently appraised.

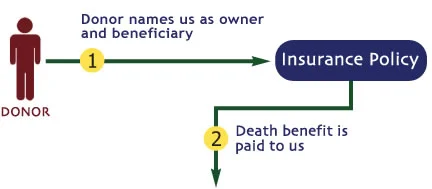

GIFTS OF LIFE INSURANCE

Life Insurance is another way to make a sizeable gift to the church. For example: You can purchase a new policy and make the church the owner and beneficiary of the policy. This enables you to “leverage” your gift, ultimately making a much larger gift than otherwise possible. Contributions to your church to pay the ongoing premiums become tax deductible.

You can make the church the owner and beneficiary of an existing policy. The current value of the policy is tax deductible, as are future premium payments. You can make the church a contingent beneficiary of an existing policy, or name the church to receive the proceeds of the policy if the designated beneficiaries predecease the insured.

Also, the remainder value of many retirement accounts can be heavily taxed when left to friends and family, but pass tax-free to your church upon your death. Review with your attorney or financial advisor to learn if this is an appropriate gift for you.

retirement accounts - Charitable IRA distribution

In 2015 and subsequent years, eligible IRA owners can make qualified charitable distributions up to $100,000 ($200,000 for married couples who each qualify separately) from Traditional IRAs without having to pay federal income taxes (see footnote 1) on the distributions. These distributions are not tax deductible and must be made payable directly to a qualified charity. (see footnote 2)

If you want to support your favorite cause or secure a legacy that lasts beyond your lifetime, there are a number of philanthropic strategies designed to help you direct your wealth in ways that reflect your values and beliefs—while also meeting your personal goals and providing tax benefits. One strategy you may want to consider is to make a federal tax-free charitable distribution from your Traditional IRA or rollover IRA (IRRA®). (see footnote 3)

This is a complex strategy and you should consult with your tax advisor before making a federally tax-free charitable distribution from your IRA.

Who qualifies for this strategy?

You must be age 70½ or older at the time of the distribution.

You may distribute any amount up to $100,000 per tax year.

You and your spouse may make combined distributions up to $200,000, provided each of you owns at least one IRA, and each of you is at least 70½ years old at the time of the

distribution and can make a qualified charitable distribution up to $100,000 from your respective IRA accounts.

You may distribute from your Traditional IRA and IRRA. Distributions may not be made from SEP and SIMPLE IRAs.(see footnote 3)

Where can you direct contributions?

The distribution proceeds must be paid directly to the qualified charity.

Charities must receive distributions for each tax year no later than December 31 of the respective tax year to be considered donated to the charity for the year.

Donor advised funds and certain private foundations are not eligible charities. You must check with your tax advisor to determine whether a charity is qualified to receive an IRA charitable distribution under applicable tax law.

You must obtain written acknowledgment of each IRA contribution from each qualified charity recipient to receive the tax-free treatment.

You cannot receive any goods or services in return for the charitable IRA contribution.

How do you apply this strategy?

Your financial advisor can help you evaluate this strategy to determine whether it makes sense in your overall estate plan. If you decide to implement this strategy and initiate a distribution from your IRA, you or your financial advisor must complete an IRA/IRRA One-Time Distribution Form.

Can you use the qualified charitable distribution to meet required minimum distributions for the year?

Yes, you can use up to the entire $100,000 per person each year. If you have not taken your RMD before the end of the tax year, and you plan to take the RMD as a qualified charitable distribution, you have until December 31 of the respective tax year to make the distribution. The amount distributed as a charitable IRA distribution is included in the owner’s required minimum distribution for the year.

Can you consider distributions taken during the respective tax year to be qualified charitable distributions?

Distributions taken within the tax year can be considered qualified charitable distributions only if they were paid directly to the qualified charity.

To whom should your distribution checks be payable?

The institution which manages your IRA will make the check payable to the qualified charity. You cannot receive a distribution payable to you and then issue a second check to the charity.

How is recovery of basis handled?

You may only take qualified charitable distributions from taxable amounts in an IRA. For purposes of the charitable distribution rules, pre-tax assets are treated as having been distributed first from your account.

How is the qualified charitable distribution status determined?

It is the sole responsibility of the IRA and IRRA account owners to determine whether a distribution constitutes a qualified charitable distribution, including, but not limited to, determining whether the donee qualifies as an eligible charitable organization. You should consult a tax professional before considering any distributions from an IRA.

What happens if you have periodic distributions of RMDs (Required Minimum Distribution)?

You should request an additional one-time distribution to take advantage of this provision.

1 Please consult your tax advisor to discuss any tax implications of executing this strategy.

2 The applicable law defines a qualified charity as an organization described in Internal Revenue Code Section 170(b)(1)(A), other than a Code Section 509(a)(3) private foundation or a Code Section 4966(d)(2) donor-advised fund. Distributions to donor-advised funds, private foundations, and supporting organizations do not qualify for tax-free IRA rollover treatment.

3 Only traditional retirement accounts are eligible for tax-free IRA rollover treatment. Charitable distributions from 403(b) plans, 401(k) plans, pension plans, or other retirement plans are ineligible.

As always, please consult an Attorney, Accountant and/or Financial Advisor about charitable contribution strategies and associated tax ramifications.

Please contact our Priest-In-Charge The Rev. Ophelia Laughlin: rector@StMatthewsPennington.org if you are interested in making a bequest or estate gift. The office phone number is 609-737-0985. All interactions are strictly confidential.

Part of the information contained herein provided by the Episcopal Church Foundation. Please click on the link to view details on their site.